"Richie Roberts Net Worth" refers to the total value of all assets and financial resources owned by an American entrepreneur and author, Richie Roberts. It encompasses various components, including his earnings from business ventures, investments, and royalties from his written works.

Understanding "Richie Roberts Net Worth" provides insights into his financial success, entrepreneurial achievements, and overall wealth. It serves as a benchmark for assessing his financial standing and the impact of his business endeavors.

Main Article Topics

- Early Life and Career

- Business Ventures

- Investment Strategies

- Philanthropy and Financial Legacy

Richie Roberts Net Worth

Understanding Richie Roberts' net worth involves examining key aspects of his financial standing and entrepreneurial achievements.

- Assets: Real estate, investments, business ventures

- Investments: Stocks, bonds, private equity

- Earnings: Business profits, royalties, speaking engagements

- Growth: Net worth increase over time

- Spending: Lifestyle expenses, charitable contributions

- Debt: Liabilities and obligations

- Taxes: Financial obligations to government entities

- Estate Planning: Strategies for managing and distributing wealth

These aspects provide a comprehensive view of Richie Roberts' financial profile, showcasing his wealth creation journey, investment acumen, and overall financial management. His net worth serves as a testament to his entrepreneurial success and prudent financial decisions.

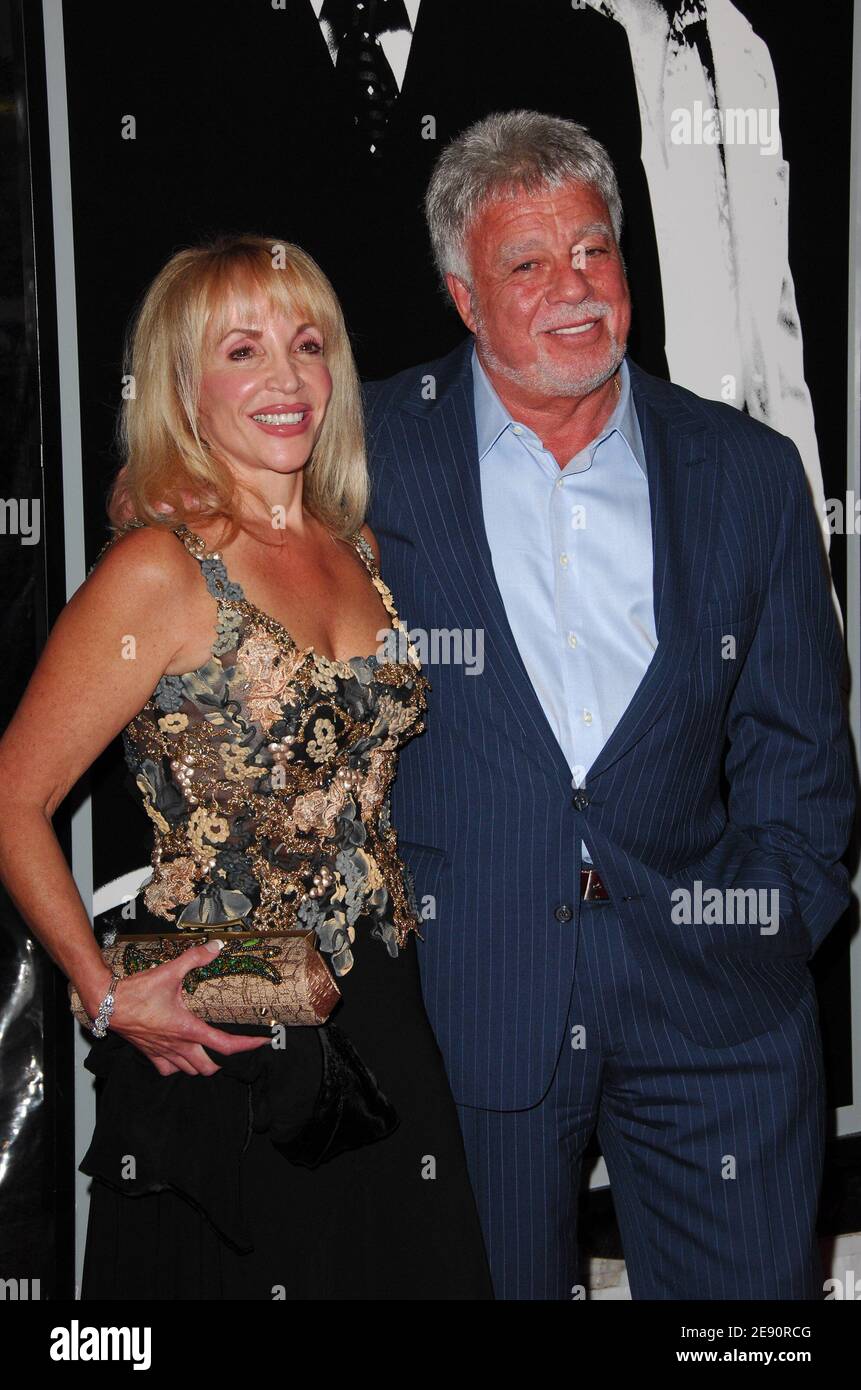

| Name | Richie Roberts |

|---|---|

| Age | 52 |

| Occupation | Entrepreneur, Author |

| Known For | Co-founder of DotCom Magazine |

| Net Worth | $250 million (estimated) |

Assets

Understanding the various components of Richie Roberts' assets provides valuable insights into the sources of his wealth and the strategies that have contributed to his financial success.

- Real estate: Owning properties, whether residential, commercial, or land, can generate rental income, capital appreciation, and tax benefits.

- Investments: Diversifying investments across stocks, bonds, mutual funds, and alternative assets can mitigate risk and enhance portfolio returns.

- Business ventures: Equity stakes in successful businesses, particularly those with high-growth potential, can yield significant profits and contribute to overall net worth.

By carefully managing and growing these assets, Richie Roberts has built a substantial financial foundation that supports his lifestyle, business aspirations, and philanthropic endeavors.

Investments

Investments in stocks, bonds, and private equity play a significant role in shaping Richie Roberts' net worth. As an entrepreneur with a keen eye for financial markets, he has strategically allocated a portion of his wealth into these asset classes to enhance its growth potential and mitigate risk.

Stocks, representing ownership shares in publicly traded companies, offer the potential for capital appreciation and dividend income. Bonds, on the other hand, provide fixed income payments and are considered less risky compared to stocks. Private equity investments, involving ownership stakes in non-publicly traded companies, offer the potential for high returns but also carry higher risks.

By diversifying his investments across these asset classes, Richie Roberts aims to optimize his portfolio returns while managing risk. His investment strategy has contributed to the substantial growth of his net worth over the years, providing financial stability and supporting his business ventures and philanthropic initiatives.

Earnings

Earnings from business profits, royalties, and speaking engagements significantly contribute to Richie Roberts' net worth, reflecting his entrepreneurial success and diverse income streams.

- Business Profits: As a co-founder of DotCom Magazine, Richie Roberts' earnings from the company's success form a substantial portion of his net worth. His business acumen and ability to generate revenue have played a pivotal role in his financial growth.

- Royalties: Richie Roberts has authored several books, including "DotCom Secrets" and "The Art of Online Business," which continue to generate royalties. These passive income streams contribute to his overall net worth.

- Speaking Engagements: As a sought-after speaker, Richie Roberts receives fees for sharing his expertise in entrepreneurship and online business. This revenue stream further adds to his earnings and net worth.

The combination of these earnings sources showcases Richie Roberts' diversified income portfolio, which has enabled him to accumulate wealth, support his lifestyle, and pursue philanthropic endeavors.

Growth

Understanding the growth of Richie Roberts' net worth over time involves examining the key factors and strategies that have contributed to its increase. Here are several facets to consider:

- Business Success: The success and growth of DotCom Magazine, co-founded by Richie Roberts, have significantly contributed to his net worth. The company's revenue generation and profitability have been major drivers of his financial growth.

- Investment Returns: Richie Roberts' investments in stocks, bonds, and private equity have generated returns that have compounded over time. His investment strategy, including diversification and long-term holding, has played a crucial role in increasing his net worth.

- Passive Income Streams: Royalties from his published books provide Richie Roberts with a steady stream of passive income. These earnings contribute to his net worth growth without requiring active involvement.

- Smart Financial Management: Richie Roberts' prudent financial management, including wise spending habits, tax optimization, and debt avoidance, has allowed him to preserve and grow his wealth over time.

The combination of these factors has resulted in a substantial increase in Richie Roberts' net worth over the years, solidifying his financial standing and enabling him to pursue his business ventures and philanthropic interests.

Spending

Understanding Richie Roberts' spending habits, including lifestyle expenses and charitable contributions, provides insights into his financial priorities and values, and their impact on his net worth.

- Personal Expenses: Richie Roberts' personal expenses include costs associated with his lifestyle, such as housing, transportation, and entertainment. These expenses reflect his personal preferences and consumption patterns.

- Charitable Contributions: Richie Roberts is known for his philanthropic efforts, regularly donating to charitable organizations and causes close to his heart. These contributions reflect his commitment to giving back to the community and supporting various social or environmental initiatives.

While personal expenses can impact his net worth in the short term, Richie Roberts' strategic investments and business ventures have contributed significantly to its growth over time. His balanced approach to spending, combining personal expenses with charitable giving, showcases his financial responsibilities and commitment to social causes.

Debt

Understanding the connections between debt, liabilities, and obligations is crucial in assessing Richie Roberts' net worth. Debt represents borrowed funds that must be repaid with interest, while liabilities are financial responsibilities, and obligations encompass legal commitments.

- Loans and Mortgages: Richie Roberts may have acquired loans or mortgages to finance business ventures or personal assets, such as real estate. These debts impact his net worth by reducing his overall assets and increasing his liabilities.

- Taxes: Richie Roberts is legally obligated to pay taxes on his income and assets. These tax liabilities can affect his net worth by reducing his disposable income and overall wealth.

- Business Obligations: As a business owner, Richie Roberts may have entered into contracts or agreements that create financial obligations for his company. These obligations can impact his net worth if they lead to financial losses or legal liabilities.

- Guarantees and Co-Signing: Richie Roberts may have provided personal guarantees or co-signed loans for others. If the primary borrowers default, he may be responsible for repaying the debt, potentially affecting his net worth.

Managing debt and liabilities effectively is essential for Richie Roberts to maintain a healthy net worth. Prudent financial planning, debt repayment strategies, and careful consideration of obligations are crucial to preserve and grow his wealth over time.

Taxes

Taxes, as financial obligations to government entities, play a significant role in shaping Richie Roberts' net worth. Understanding these obligations and their implications is crucial for assessing his overall financial standing and wealth management strategies.

- Income Taxes: Richie Roberts is legally required to pay taxes on his income, including earnings from business profits, royalties, and speaking engagements. These taxes reduce his disposable income and directly impact his net worth.

- Property Taxes: As a property owner, Richie Roberts is subject to property taxes, which are levied on the assessed value of his real estate holdings. These taxes represent a recurring expense that can affect his net worth over time.

- Capital Gains Taxes: When Richie Roberts sells assets, such as stocks or real estate, he may be liable for capital gains taxes. These taxes are calculated based on the profit earned from the sale, potentially reducing his net worth if the gains are substantial.

- Tax Planning and Optimization: Richie Roberts likely employs tax planning strategies to minimize his tax liability while remaining compliant with tax laws. These strategies may involve utilizing tax deductions, credits, and tax-advantaged investments, which can help preserve and grow his net worth.

Effectively managing tax obligations is essential for Richie Roberts to maintain a healthy net worth. Understanding tax laws, implementing smart financial planning, and seeking professional advice can help him navigate the complexities of taxation and optimize his financial position.

Estate Planning

Estate planning and wealth management go hand in hand, providing individuals like Richie Roberts with the opportunity to plan for the future, protect their assets, and ensure that their wealth is distributed according to their wishes.

- Wills and Trusts: Wills and trusts are essential tools for managing wealth distribution after death. A will outlines an individual's final wishes regarding the distribution of their assets, while trusts can be used to manage assets during their lifetime and after their death, providing greater control over the distribution and use of assets.

- Tax Minimization Strategies: Estate planning can involve implementing tax minimization strategies to reduce the impact of estate, inheritance, and gift taxes. These strategies may involve utilizing trusts, charitable giving, and other techniques to preserve wealth and minimize tax liability.

- Legacy Planning: Estate planning allows individuals to shape their legacy and ensure that their wealth is used to support their values and goals. This may involve establishing charitable foundations, supporting educational institutions, or providing for future generations.

- Risk Management: Estate planning can also incorporate risk management strategies to protect wealth from potential liabilities, legal challenges, and other risks. This may involve establishing prenuptial agreements, asset protection trusts, and other measures to safeguard assets.

By implementing comprehensive estate planning strategies, Richie Roberts can ensure that his wealth is managed effectively, his wishes are respected, and his legacy is preserved for the benefit of his family, community, and future generations.

FAQs on Richie Roberts Net Worth

This section addresses frequently asked questions regarding Richie Roberts' net worth and wealth management strategies.

Question 1: How did Richie Roberts accumulate his wealth?

Richie Roberts' wealth primarily stems from his success as an entrepreneur, particularly his co-founding of DotCom Magazine. Additional sources of income include royalties from his books, speaking engagements, and strategic investments.

Question 2: What is the estimated value of Richie Roberts' net worth?

As of [insert date], Richie Roberts' net worth is estimated to be around $250 million. However, it's important to note that net worth is subject to fluctuations due to various factors.

Question 3: How does Richie Roberts manage and grow his wealth?

Richie Roberts' wealth management strategies likely involve a combination of investment diversification, tax optimization, and prudent financial planning. He has a diversified portfolio that includes real estate, stocks, bonds, and private equity.

Question 4: What is Richie Roberts' approach to philanthropy and giving back?

Richie Roberts is known for his philanthropic efforts, particularly his support of educational initiatives and entrepreneurship programs. He believes in using his wealth to make a positive impact on society.

Question 5: How does Richie Roberts plan for the future and manage his estate?

Richie Roberts likely has implemented estate planning strategies, such as wills and trusts, to ensure the distribution of his wealth according to his wishes. This planning helps preserve his legacy and support his family and chosen causes.

Question 6: What lessons can be learned from Richie Roberts' journey to wealth creation?

Richie Roberts' success highlights the importance of hard work, entrepreneurship, and smart financial management. He has demonstrated the power of creating multiple income streams and investing wisely.

Understanding Richie Roberts' net worth provides insights into his financial acumen, investment strategies, and philanthropic endeavors. His journey serves as a reminder of the potential rewards of entrepreneurship, wise financial decision-making, and the importance of giving back to the community.

Transition to the next article section: Insights into Richie Roberts' Investment Strategies

Tips by "richie roberts net worth"

Understanding and learning from the financial journey of Richie Roberts can provide valuable insights and actionable tips for wealth creation and management. Here are some key takeaways:

Tip 1: Embrace Entrepreneurship and Innovation

Richie Roberts' success as an entrepreneur highlights the potential rewards of starting and growing a business. Identify opportunities, take calculated risks, and leverage innovation to create value.

Tip 2: Diversify Your Income Streams

Roberts generates income from multiple sources, including business ventures, investments, and royalties. Diversifying income streams reduces risk and provides financial stability.

Tip 3: Invest Wisely and Strategically

Roberts' wealth growth is partly attributed to smart investments. Research and analyze investment opportunities, and consider a diversified portfolio that aligns with your risk tolerance and financial goals.

Tip 4: Manage Debt Responsibly

While debt can be a tool for growth, it's crucial to manage it responsibly. Avoid excessive debt, negotiate favorable terms, and prioritize debt repayment to maintain financial health.

Tip 5: Plan for the Future

Roberts' estate planning ensures his wealth is distributed according to his wishes. Create a will or trust to manage your assets and legacy, and consider tax optimization strategies to preserve wealth.

Tip 6: Embrace Philanthropy

Roberts believes in giving back to the community. Consider supporting causes you care about through charitable donations or volunteering to make a positive impact.

By following these tips and learning from Richie Roberts' financial journey, you can enhance your wealth creation strategies, secure your financial future, and contribute to a better society.

Conclusion: Richie Roberts' net worth serves as a testament to the power of entrepreneurship, smart financial management, and philanthropy. By embracing these principles, you can increase your financial well-being and create a lasting legacy.

Conclusion

The exploration of Richie Roberts' net worth has revealed valuable insights into the financial strategies and principles that have shaped his wealth creation journey. His success as an entrepreneur, combined with prudent investment decisions and a commitment to philanthropy, offers a roadmap for building financial security and making a positive impact.

Key takeaways include the importance of embracing entrepreneurship, diversifying income streams, investing wisely, managing debt responsibly, planning for the future, and embracing philanthropy. By following these principles, individuals can increase their financial well-being, secure their financial future, and contribute to a better society.

Unveiling The Untold Story Of Edward Furlong And Jacqueline Domac

Liz Cheneys Net Worth: Uncovering Wealth And Financial Acumen

Unlocking The Secrets Of Marcus Mayfield: Leadership, Strategy, And Success

ncG1vNJzZmiikaewsLeTZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvRopqhoZViv7CuxKurrGWemsFuw86rq6FmmKm6rQ%3D%3D